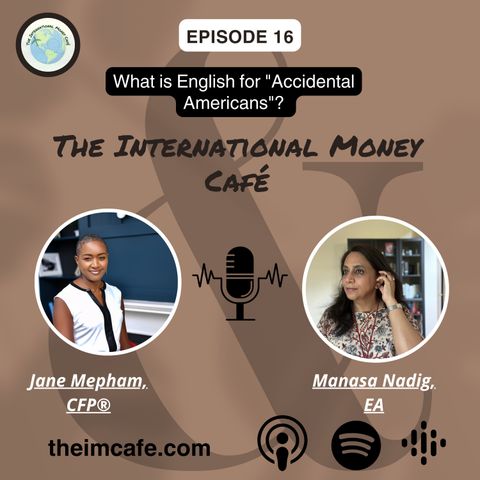

EP 16: What is English for "Accidental Americans"?

Descarga y escucha en cualquier lugar

Descarga tus episodios favoritos y disfrútalos, ¡dondequiera que estés! Regístrate o inicia sesión ahora para acceder a la escucha sin conexión.

Descripción

According to migration policy data, the highest number of immigrants are trying to get to the US. For those wanting to become Americans, it's a stressful situation, and the process...

mostra másBut then there is another group of people who live outside the US, some of whom have no idea they are Americans, especially because they don't have a US passport. For the record, not having a passport does not determine citizenship.

This group somehow acquired US citizenship because they were born to US citizens outside the country (probably on deployment), were born to non-immigrants in the US, or were born to US parents but left the US at a very young age. They may not be aware of it, but they are "American." in all ways possible.

We call this group "Accidental Americans."

In today's "shortie" episode, we discuss the implications of being an accidental American and the tax and financial implications of being an American overseas and make suggestions on how to deal with them. Ignorance is no defense, and you can't really ignore it.

IRS wants you to pay US taxes like other US tax persons or officially quit (exit).

We also discuss probably the most famous accidental American - Boris Johnson - a former U.K. prime minister.

We enjoyed digging into the details of this one.

The speakers' views and opinions discussed in this episode should not be considered financial, tax, or legal advice. Consult your advisor for any legal, cross-border tax, and financial advice.

Be sure to join the conversation by visiting our page The International Money Cafe

Or by following us on social media:-

Follow us on social media:- LinkedIn; Instagram; Twitter (X); Facebook

Información

| Autor | The International Money Cafe |

| Organización | MANASA NADIG |

| Página web | - |

| Etiquetas |

Copyright 2024 - Spreaker Inc. an iHeartMedia Company

Comentarios